Aug 23, 2023Tax Credits for Used Electric Vehicles. You’re eligible for the same tax exemptions when buying used EVs! The rules are slightly different, though. The total transaction for used EVs must not exceed $30,000 in fair market value or lease payments. Until July 31, 2023, Washington State exempts up to $16,000 of the sale or leased price for used

The next wave of electric vehicles is coming — and it could be buses, semis and other large trucks | CBC News

Exemptions — Electric vehicle batteries and fuel cells … The sale of batteries or fuel cells for electric vehicles, including batteries or fuel cells sold as a component of an electric bus at the time of the vehicle’s sale; … Sellers may make tax exempt sales under this section only if the buyer provides the seller with an exemption

Source Image: themanual.com

Download Image

Sep 8, 2023(The Center Square) – Washington state has given 25,276 sales and use tax exemptions for electric vehicles since 2019 to reduce greenhouse gas emissions, costing $27.9 million. The exemption aims to help reduce GHG emissions by 45% by 2030 and 70% by 2040 because vehicle emissions are the largest contributor to GHGs, an executive order says.

Source Image: cnet.com

Download Image

Why You Should Consider Buying A Used Electric Car Beginning July 28, 2019, a new law makes several changes to the sales tax exemption for electric vehicle infrastructure, and the leasehold excise tax exemption. What’s new? sales tax exemption extended to July 1, 2025 use tax exemption effective Aug. 1, 2019 through July 1, 2025 includes the sale of zero emissions buses includes the sale of

Source Image: blog.wa.aaa.com

Download Image

Washington State Sales Tax Exemption Electric Vehicles

Beginning July 28, 2019, a new law makes several changes to the sales tax exemption for electric vehicle infrastructure, and the leasehold excise tax exemption. What’s new? sales tax exemption extended to July 1, 2025 use tax exemption effective Aug. 1, 2019 through July 1, 2025 includes the sale of zero emissions buses includes the sale of Mar 20, 2023Nov. 10, 2023, at 5:22 p.m. Washington EV Tax Credits Guide. Getty Images. The state of Washington has long proven its reputation for being accepting and encouraging of alternative fuels and electric vehicle adoption. The state provides tax exemptions, rather than tax credits, for qualified EV purchases and infrastructure upgrades.

Tax Credits And Electric Cars – AAA Washington | Articles, News And Advice

Feb 4, 2024A WA state rebate coming soon could make buying an electric vehicle more affordable. … can be combined with a state sales tax waiver on up to $15,000 of the purchase price of new cars valued at How Much are Used Car Sales Taxes in Washington?

Source Image: privateauto.com

Download Image

Many electric vehicles to lose big tax credit with new rules | AP News Feb 4, 2024A WA state rebate coming soon could make buying an electric vehicle more affordable. … can be combined with a state sales tax waiver on up to $15,000 of the purchase price of new cars valued at

Source Image: apnews.com

Download Image

The next wave of electric vehicles is coming — and it could be buses, semis and other large trucks | CBC News Aug 23, 2023Tax Credits for Used Electric Vehicles. You’re eligible for the same tax exemptions when buying used EVs! The rules are slightly different, though. The total transaction for used EVs must not exceed $30,000 in fair market value or lease payments. Until July 31, 2023, Washington State exempts up to $16,000 of the sale or leased price for used

Source Image: cbc.ca

Download Image

Why You Should Consider Buying A Used Electric Car Sep 8, 2023(The Center Square) – Washington state has given 25,276 sales and use tax exemptions for electric vehicles since 2019 to reduce greenhouse gas emissions, costing $27.9 million. The exemption aims to help reduce GHG emissions by 45% by 2030 and 70% by 2040 because vehicle emissions are the largest contributor to GHGs, an executive order says.

Source Image: forbes.com

Download Image

Washington state has given 25,276 EV sales and use tax exemptions since 2019 | Washington | thecentersquare.com Feb 10, 2024The state also offers a tax waiver on clean alternative fuel vehicles, which applies only to new cars valued at $45,000 or less, or used that run $30,000 or less. Be sure to confirm eligibility

Source Image: thecentersquare.com

Download Image

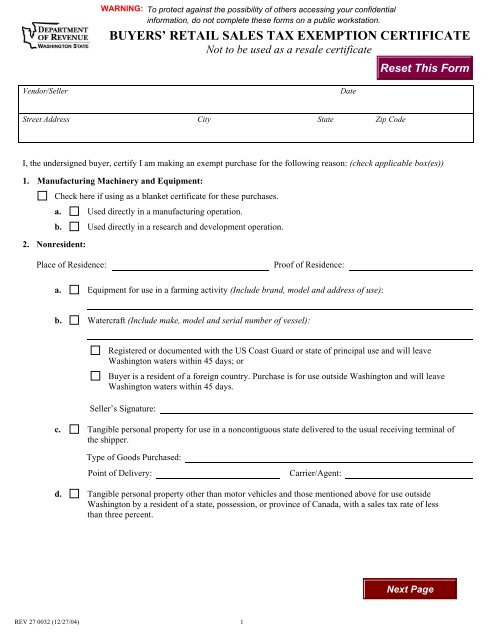

Buyers’ Retail Sales Tax Exemption Certificate Beginning July 28, 2019, a new law makes several changes to the sales tax exemption for electric vehicle infrastructure, and the leasehold excise tax exemption. What’s new? sales tax exemption extended to July 1, 2025 use tax exemption effective Aug. 1, 2019 through July 1, 2025 includes the sale of zero emissions buses includes the sale of

Source Image: yumpu.com

Download Image

BMW, Rivian, Hyundai, Volvo lose access to EV tax credit | TechCrunch Mar 20, 2023Nov. 10, 2023, at 5:22 p.m. Washington EV Tax Credits Guide. Getty Images. The state of Washington has long proven its reputation for being accepting and encouraging of alternative fuels and electric vehicle adoption. The state provides tax exemptions, rather than tax credits, for qualified EV purchases and infrastructure upgrades.

Source Image: techcrunch.com

Download Image

Many electric vehicles to lose big tax credit with new rules | AP News

BMW, Rivian, Hyundai, Volvo lose access to EV tax credit | TechCrunch Exemptions — Electric vehicle batteries and fuel cells … The sale of batteries or fuel cells for electric vehicles, including batteries or fuel cells sold as a component of an electric bus at the time of the vehicle’s sale; … Sellers may make tax exempt sales under this section only if the buyer provides the seller with an exemption

Why You Should Consider Buying A Used Electric Car Buyers’ Retail Sales Tax Exemption Certificate Feb 10, 2024The state also offers a tax waiver on clean alternative fuel vehicles, which applies only to new cars valued at $45,000 or less, or used that run $30,000 or less. Be sure to confirm eligibility